Hi fellow Liberal Financiers, I'm here to talk to you today about Bonds and Stocks. There has always been debate circling these two investment options. Are Bonds the smarter investments or is Stock the smarter investment? Are Bonds more lucrative or is Stock more lucrative? Here is a breakdown as to why, in the year 2013, Stocks are superior to Bonds.

*DISCLAIMER* (Note however, no one option is mutually or exclusively superior to the other. They both have similar and different functions which together make a diverse and satisfying portfolio. Also, this post is in reference to the year and 365 day period, of 2013. For the year 2013 stocks would be preferable to bonds, this article should not be taken into past date or extended contexts.)

Let's start with what the two are and what they represent:

The American Savings Bond:

The American Savings Bond, the bread and butter of our economy and America's WWII savior. Savings bonds have always been associated with wealth, growth, returns, and fiscal responsibility. They are heroes in bear markets and also very secure. They also hold a very special place in the hearts of older American citizens raging from people who were alive or born in the years 1930-1950.

What is a Savings Bond?

- By definition, a Savings Bond or just Bond is a debt investment in which an investor loans money to an entity (corporate or governmental) that borrows the funds for a defined period of time at a fixed interest rate.

- By connotation, a Savings Bond or just Bond is a promise you receive from the government which states in return for "buying" our bond, at the bond's maturity date, we will give back the money paid for our bond and the interest that the bond garnered.

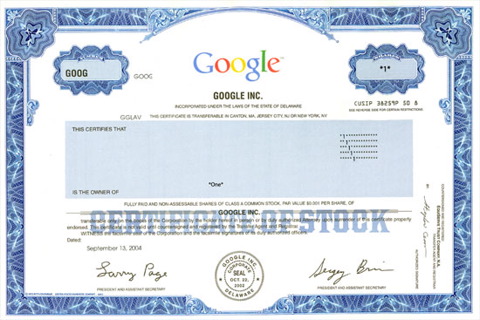

Company Stock:

Truth is, living in America, one cannot escape hearing or reading about the wonderful nature of stocks or the (sometimes lucky) individuals who invest their money in them. In the world of investments, stocks are appealing. They are a gamble, but they have the opportunity to bring in high yields. Along with bonds and cash, stocks are one of the three main asset classes. What makes them different from bonds however, is that stock yieldings are not fixed. One does not know (or better yet, the untrained eye doesn't know) how much money will be made buying stock (financial analysts are extremely skilled and usually correct when it comes to calling stock yields and performance but no one knows exactly how a stock will perform). Someone who invests $10,000 in stocks could very well end up making $1,000,000 in the long run. Someone who invests $10,000 in bonds however will always get $10,000+interest.

What is a Stock?

- By definition, stock is a claim to a corporation's assets and earnings. There are two different kinds of stocks however: there is common stock and there is preferred stock. Common stock provides voting rights (rules vary corporation to corporation). Preferred stocks pays dividends when a company has excess cash (*a company is not required to pay dividends if it is not financially able to do so); also if bankruptcy is declared, preferred stock-share holders get priority rights when being compensated.

- By connotation, stock is the number of shares one owns in a company. When stock prices increase money is earned on the existing shares and vice versa when stock prices decrease.

Which is the better investment in the year 2013?

For the year 2013, markets, research, and the economy have all rendered stock the preferable choice. Why is that? Well for starters, stock is going to give a better return right now than a bond would. I know some may think, well that is unfair seeing that bonds have to mature and yes, that is correct thinking. However, when I say stocks will give a better return, I'm actually saying (by market indication) that a stock purchased in 2013 vs. a bond purchased in 2013, in the course of about 5 years, the stock will give a higher return. And here is why:

- Bond interest rates are relatively low in retrospect to the 'on the horizon'-bull economy.

- Bonds currently are merely a upscale, more risqué savings account.

- *****Washington D.C., due to the ongoing feud between the Democrats and the GOP is in mounds and heaps of uncertainty.

- The Treasury (the issuer of savings bonds) is not stable (i.e. the trillion dollar coin anyone?).

- The Treasury owes too much debt as it is and should not be taking on more through savings bonds.

- The Treasury is completely bankrupt.

- *Also stock is just the it-item of the year. Yes it is trendy but it is overall showing good returns.

What this means for the rest of us?

Non-Investors:

For those who are non-investors but watch the financial world, generally this means nothing. Either way as non-investors these figures (for the most part) aren't going to affect our daily lives. However, the financial world always seem to indirectly affects us anyways so this should mainly serve as a reference to what's going on.

Small-Time investors:

For small time investors, this is most certainly a great time to join or fully engage in the market. As a small-time investor, rather than trying to secure future pensions, the focus in investing within the stock market is more so investing excess cash to earn extra money. With that being stated, we all want extra cash and stocks are performing well, so rather purchasing a bond, go for a stock.Bigger Investors:

Well most likely, a big time investor would not be taking financial advice from me (that's what Merril Lynch, Goldman Sachs, and JP Morgan are for) but if any big time investors are listening, a really diverse, fractional proportion of both would do the trick. Bonds of course are never without its merit but there is potential for stock in 2013. Case-and-point all the excess money made in 2013 from investing in stocks, can provide more money for investing in bonds in 2014.

Thank you Liberal Financiers for listening and reading and good luck to you in your 2013 investments!

No comments:

Post a Comment