Let me start this argument off by saying: (excuse the language) Hell no!

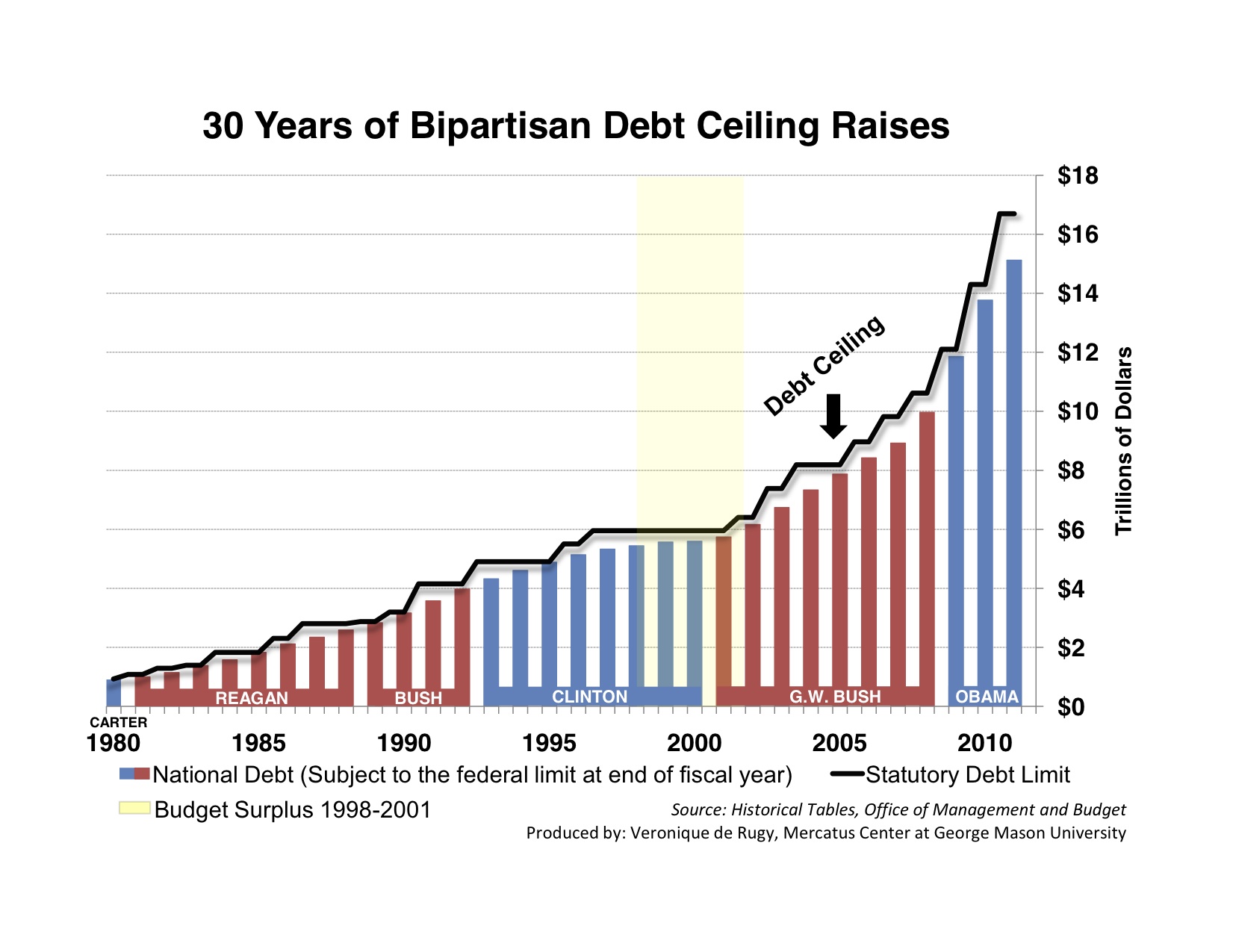

Absolutely not! Congress should not raise the debt limit, they shouldn't even think about raising the debt limit, not even for one trillionth of a milli-second. The debt ceiling has been raised countless times and as shown by our $16,000,000,000,000 debt, raising the debt ceiling fixes nothing—and that may be an overstatement. The "debt ceiling" at this point doesn't even exist—it's an imaginary word, used in reference of an imaginary concept to fixate the mind on an imaginary number—used solely for media and headline purposes only.

I'm not sure about anyone else, but I know I (for one) am completely sick of hearing about this topic. This topic is a cliché now. At this point, everyone knows a couple things about the government:

- Wall Street and the rest of the world is not concerned with the American Government's fiscal mishaps.

- The government is on a slow voyage to complete and utter destruction and collapse.

- The government is using yellow journalism tactics to make issues seem more relevant than they are.

- *AND MOST IMPORTANTLY* The White House is not the economy.

Case-and-point: the government is absolutely and completely bankrupt; yet somehow, analysts are optimistic for a bull economy in 2013.

This is because the government is not actually the economy, merely a player. The government however tries to link itself and make itself appears as if it is.

What is our debt ceiling?

The media loves to make governmental fiscal matters seem more complex in nature. (This is so consumers will take less interest in the actuality of the matters and also in hopes that the general population will be more inclined to have a "leave it to the professionals" attitude, the "professionals" being the government.) However, the debt ceiling is a very simple concept.

*NOTE* (When explaining government matters, I love to reference it in simple matters. Not because the content is confusing, but because when you remove the "glamour", government spending is very simple.)

This is what's going on:

The government has an income. The government has responsibilities. Like anyone else however, the government also has its wants (and also unlawful obligations). So after paying for its wants (and unlawful obligations), the government, if it has any money left over, uses its excess money to pay for it's responsibilities. Problem lies that the government usually doesn't have money to cover its wants, much less its responsibilities, so rather than prioritizing or using only the money it takes in, like a lot of Americans: it borrows money.That in a nutshell is how the government acquires it's debt—borrowing money.

Our debt ceiling is supposedly put in place to say after a certain amount of borrowing (and spending): "Hey, pay the money that you owe and stop being so irresponsible with your income". Our debt ceiling is supposed to be the amount of money the government can acquire in debt before it has to stop borrowing and lavishly spending money. (Note that I say '"supposed to be")

Are we over our debt limit?

Is the sky blue? Did Apple's stock not plummet like an Olympic diver? Does that star-spangled banner not yet wave? Well then, my friends, you have your answer. The government is over our solar system's head in debt.

Our government is our irresponsible parent. They are horrible when it comes to budgeting and correctly spending its money. We pay the price for this.

How far are we over the limit? Well for starters the government is currently $16,447,157,000,000☨ in debt [timestamp: 5:31am 1/13/2013] (this is an estimate because the numbers were moving too fast for me to transcribe in entirety).

The public debt ceiling was raised to 16.4 trillion dollars which was up from 14.3 trillion in 2011.

Now we are something of 47 billion dollars over our debt limit.

A smart person would ask, well if that is the LIMIT how do you go over a the limit? Especially when spending and borrowing is supposed to halt?

I've been looking for a good answer to this question for years and honestly I simply do not know. What the numbers show obviously though is that neither spending or borrowing has ceased.

|

| http://mercatus.org/ |

So why shouldn't the debt limit be raised?

The media is filled with answers like this: when asked why we need a raise in the debt ceiling The White House answers

Because a debt default would cause widespread economic damage.Or something of that nature.

Well:

- We already are over the reassigned debt ceiling.

- The government's borrowing and spending has neither ceased nor desisted and the everyday lives of the people have not changed.

- The economy is on a rise.

Congress shouldn't raise the debt limit for these reasons:

- Not raising the debt ceiling would (or should) force the government into paying its existing debt.

- The debt is too high to ignore anymore.

- Raising the debt ceiling will give leeway for more spending and borrowing, increasing the already sky high debt, which will call for another debt ceiling raise in 2-3 years tops.

Personally, I am tired of this argument. We as citizens cannot (within reason) spend more than we have, the government is a money making entity like anyone else and should be subject to its own laws.

-Comment and tell me what you think Liberal Financiers.

___________________________________________________________________________________

Also you can check out the live US Debt Clock at http://usdebtclock.org

*Note* By the time I've finished making this post, excluding re-edit time, the debt has jumped to $16,477,190,000,000☨ up from $16,477,157,000,000☨.

**At the time of actually posting, it has now jumped to $16,477,260,000,000☨.

☨-Estimates because the numbers are moving too fast to transcribe.

No comments:

Post a Comment